Life Insurance in and around Hancock

Life goes on. State Farm can help cover it

What are you waiting for?

Would you like to create a personalized life quote?

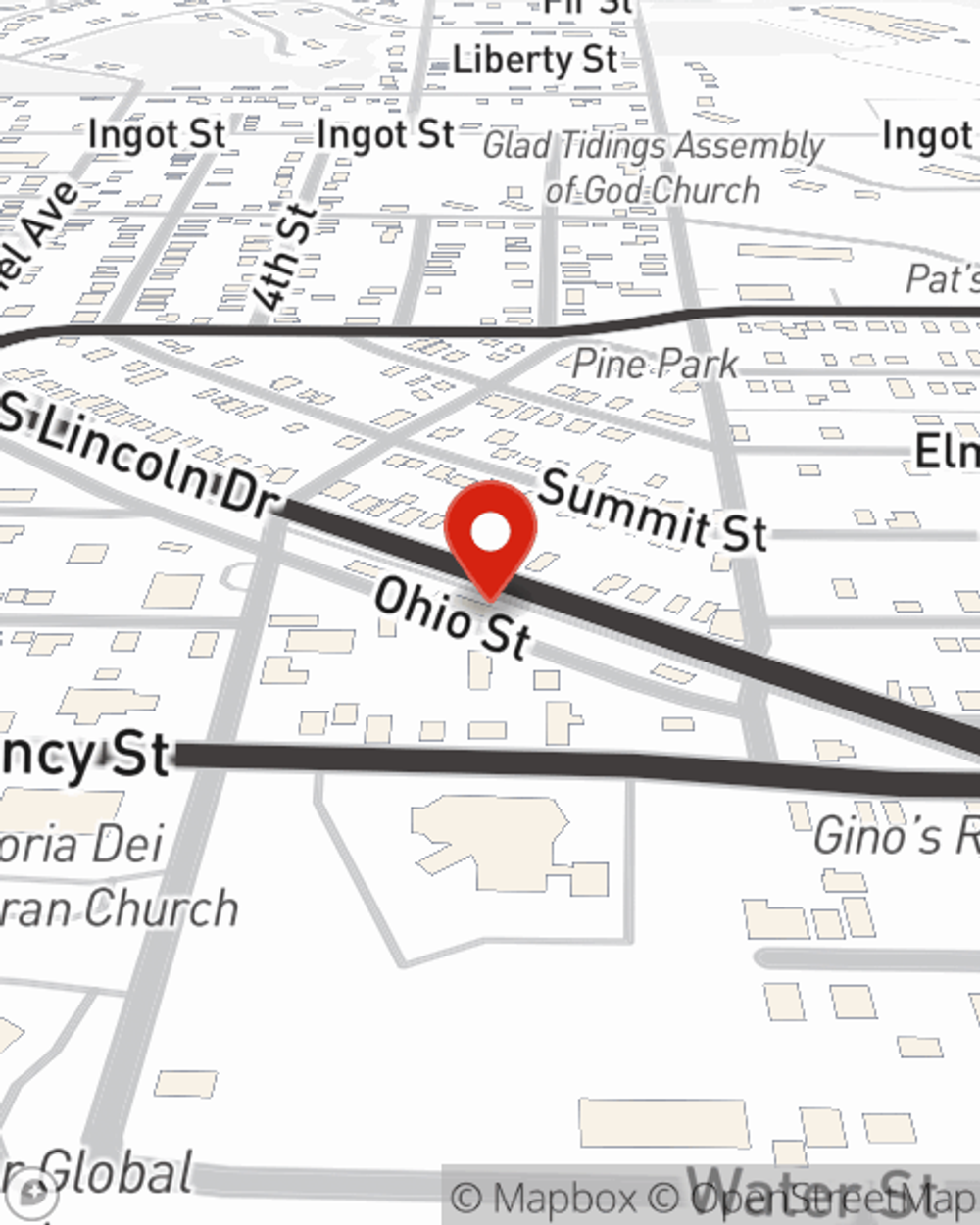

- Hancock, MI

State Farm Offers Life Insurance Options, Too

State Farm understands your desire to care for your partner after you pass away. That's why we offer wonderful Life insurance coverage options and considerate reliable service to help you choose a policy that fits your needs.

Life goes on. State Farm can help cover it

What are you waiting for?

State Farm Can Help You Rest Easy

When opting for how much coverage is right for you, it's helpful to know the factors that play into the type and amount of Life insurance you need. These tend to be things like how old you are, your physical health, and perhaps even body weight and occupation. With State Farm agent Sara Lahti, you can be sure to get personalized service depending on your individual situation and needs.

Get in touch with State Farm Agent Sara Lahti today to experience how the trusted name for life insurance can help you rest easy here in Hancock, MI.

Have More Questions About Life Insurance?

Call Sara at (906) 482-6305 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Estate planning: Understanding the basics

Estate planning: Understanding the basics

An estate plan does more than just offer direction for assets. Estate planning can help others execute your wishes and take care of those you love.

What determines the cost of life insurance?

What determines the cost of life insurance?

How do life insurance companies determine rates? And who pays more for life insurance? We break it down.

Simple Insights®

Estate planning: Understanding the basics

Estate planning: Understanding the basics

An estate plan does more than just offer direction for assets. Estate planning can help others execute your wishes and take care of those you love.

What determines the cost of life insurance?

What determines the cost of life insurance?

How do life insurance companies determine rates? And who pays more for life insurance? We break it down.