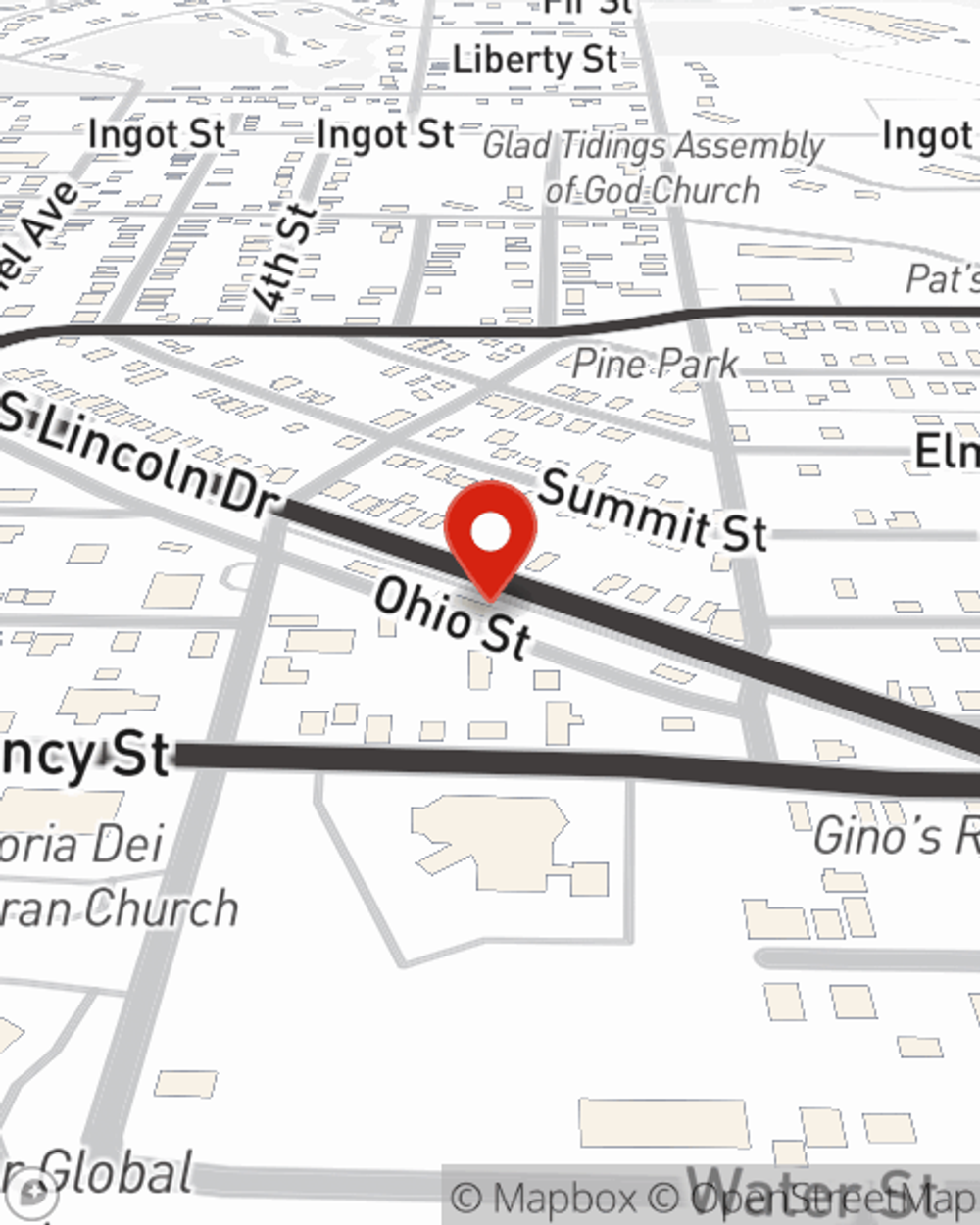

Business Insurance in and around Hancock

Hancock! Look no further for small business insurance.

Cover all the bases for your small business

- Hancock, MI

Insure The Business You've Built.

Sometimes the unpredictable is unavoidable. It's always better to be prepared for the unfortunate mishap, like a customer stumbling and falling on your business's property.

Hancock! Look no further for small business insurance.

Cover all the bases for your small business

Surprisingly Great Insurance

With State Farm small business insurance, you can give yourself more protection! State Farm agent Sara Lahti is ready to help you handle the unexpected with dependable coverage for all your business insurance needs. Such considerate service is what sets State Farm apart from other business insurance providers. And it won’t stop once your policy is signed. If the unexpected happens, Sara Lahti can help you file your claim. Keep your business protected and growing strong with State Farm!

So, take the responsible next step for your business and contact State Farm agent Sara Lahti to explore your small business insurance options!

Simple Insights®

Fire safety for businesses

Fire safety for businesses

Learn workplace fire safety and prevention tips to help protect your employees and business.

Money management strategies for the self-employed

Money management strategies for the self-employed

Working for yourself and managing money can be challenging. Create money management strategies to help your business thrive.

Sara Lahti

State Farm® Insurance AgentSimple Insights®

Fire safety for businesses

Fire safety for businesses

Learn workplace fire safety and prevention tips to help protect your employees and business.

Money management strategies for the self-employed

Money management strategies for the self-employed

Working for yourself and managing money can be challenging. Create money management strategies to help your business thrive.